Pre-Approved Capital One Credit Card Offer Details

Receiving a pre-approved Capital One credit card offer can be an exciting opportunity, as it indicates that you meet certain criteria set by the issuer for eligibility. These offers often come with specific details about the credit card, including the interest rate, credit limit, and potential rewards, giving you a clear understanding of what to expect if you choose to apply.

When you receive such an offer, it’s important to review the details carefully. Pay close attention to the terms and conditions, including any fees, annual percentage rates (APRs), and benefits associated with the card. Understanding these aspects can help you make an informed decision about whether the credit card aligns with your financial needs and goals.

Credit Card Pre-Approval Overview

Pre-approval is an initial indication from a credit card issuer that you meet certain criteria for their credit cards. It’s based on a quick evaluation of your financial information and often involves a soft credit inquiry, which does not affect your credit score.

Advantages of Pre-Approval

No Hard Credit Check Initially: Capital One’s pre-approval process starts with a soft credit inquiry, which does not impact your credit score. A hard credit check, which may slightly lower your score, only occurs if you proceed with a full application.

Matching the Right Card: Pre-approval helps you find credit cards suited to your credit profile, allowing you to make informed choices.

Capital One Credit Card Options

Capital One offers various credit cards for different credit levels:

For Fair Credit

- QuicksilverOne Rewards: Earn 1.5% cash back on all purchases. Potential for a higher credit limit after six months.

- Platinum Credit Card: Ideal for building credit with no annual or hidden fees.

For Good Credit

- Savor One Rewards: Earn cash back on dining and entertainment.

- Quicksilver One Rewards: Get 1.5% cash back on all purchases.

For Excellent Credit

- Venture One Rewards: Great for travelers with high rewards on travel expenses.

For Rebuilding Credit

- Capital One Secured Credit Card: Requires a refundable deposit. Responsible use may lead to a higher credit limit.

Top Cards for Prequalified Offers

Capital One also offers premium cards for those who prequalify:

- Venture Rewards Credit Card: Ideal for travelers, offering consistent rewards on all purchases.

- Quicksilver Cash Rewards Credit Card: Known for cash back on all purchases.

- Savor Cash Rewards Credit Card: Offers high cash back on dining and entertainment.

How to Get Pre-Approved

Getting pre-approved for a Capital One credit card is simple. Follow these steps:

- Provide basic financial information for a soft credit inquiry.

- Review the pre-approved offers.

- Choose the card that best fits your needs.

- Complete the full application to initiate a hard credit check.

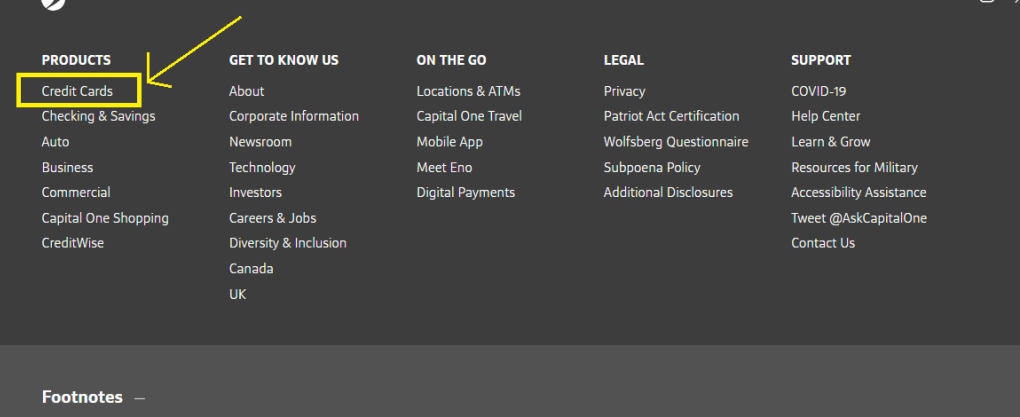

Step 1: Visit Capital One’s Website

- Go to the official Capital One website getmyoffer-capital-one.com

Find the ‘Credit Cards‘ section and look for the pre approval page

Step 2: Submit Your Details

Complete the pre-approval form by providing basic information such as your name, address, income, and Social Security number.

Step 3: Respond to Pre-Approval Inquiries

Answer questions regarding your preferences for a credit card, like whether you prefer low interest rates or cash back rewards.

Step 4: Review Your Pre-Approved Offers

Once the form is submitted, you’ll see the credit cards you are pre-approved for, determined by your financial details. This process includes a soft credit check that does not impact your credit score.

Step 5: Select a Card (Optional)

Examine the available card options and their benefits. If you find one that meets your requirements, you can proceed with the application.

Step 6: Apply for the Card (Optional)

Applying for the card will require a hard credit check, which might slightly affect your credit score. Provide the necessary application information.

Step 7: Await Approval

After submitting your application, wait for Capital One’s response. If approved, you will receive your credit card and can begin using it according to the terms and conditions.

FAQs

Our FAQ section is designed to address frequently asked questions about the specifics of our Pre-Approved Capital One Credit Card Offer. Discover detailed explanations below.

What is a pre-approved Capital One credit card offer?

A pre-approved Capital One credit card offer means you have been selected based on your credit profile to apply for a specific credit card. This offer is extended to potential customers who meet certain credit criteria, making them likely candidates for approval. However, it’s important to note that while pre-approval increases your chances, it doesn’t guarantee final approval, as the application will still undergo a thorough review process.

How do I check if I’m pre-approved for a Capital One credit card?

You can check if you’re pre-approved for a Capital One credit card by visiting the official Getmyoffer Capital One website and entering the reservation number and access code from your mail offer. This process allows Capital One to verify your identity and match you with the offer tailored to your credit profile. It’s a simple and quick way to see the credit card options available to you without impacting your credit score.

What should I do if I receive a pre-approved credit card offer from Capital One?

If you receive a pre-approved credit card offer from Capital One, review the terms and benefits of the card to determine if it suits your financial needs. Consider the interest rates, annual fees, and rewards program associated with the card. If you decide to proceed, follow the instructions provided in the offer to complete your application online or by mail. Ensure that you read all the fine print and understand the terms before applying.

Does a pre-approved offer affect my credit score?

Receiving a pre-approved offer does not affect your credit score since it involves a soft inquiry, which is not visible to other lenders. However, once you apply for the credit card, Capital One will perform a hard inquiry as part of the approval process. A hard inquiry can temporarily lower your credit score by a few points, but this impact is usually minimal and short-lived if you maintain good credit habits.

Can I decline a pre-approved Capital One credit card offer?

Yes, you can decline a pre-approved Capital One credit card offer if you decide it’s not the right fit for you. Simply ignore the offer and do not complete the application process. Declining or ignoring a pre-approved offer does not impact your credit score or your chances of receiving future offers. It’s important to choose credit products that align with your financial goals and needs.